Will the Real Estate Market Pop?

Posted by Key2See Team on March 31, 2022

Here is the trending question we encounter daily… “When will the real estate bubble pop?!”

With the financial fiasco of 2008 in the not all too distant past, it’s understandable how some could draw a comparison and expect a similar outcome. However, the cause of the housing market collapse of 2008-2009+ was not due to a housing bubble, but a financial institution collapse; what Frank Hawkins dubs, “malfeasance”.

Lending practices were so loose that people were buying multiple properties without even completing an application, called signature loans, “if you can breathe on the application you were approved.”

Due to today’s lending practices being so much tighter we won’t face the same problems with people ending up in homes they cannot afford, leading to short sales and foreclosures.

With the values of homes increasing so much, owners have remarkable equity – so rather than foreclosing one can sell, even at a reduced price, cover the debt and move on without having to give the house back to the bank.

The market won’t see the influx of properties like we did, that increase in supply and decrease in demand that was a major part of the Great Recession of 2008.

Back in 2009 26% of homeowners had negative equity in their homes, today that looks like less than 2% of homeowners. On the flip side of that, the average homeowner in the United States has 54% equity in their homes.

Read on Homeowner:

If you’re a current homeowner, you should know your net worth just got a big boost. It comes in the form of rising home equity. Equity is the current value of your home minus what you owe on the loan. Today, you’re building that equity far faster than you may expect – and this gain is great news for you.

Here’s how it happened. Home values are on the rise thanks to low housing supply and higher buyer demand. Basically, there aren’t enough homes available to meet this high buyer interest, so bidding wars are driving home prices up. When you own a home, the rising prices mean your home is worth more in today’s market. And as home values climb, your equity does too. As Dr. Frank Nothaft, Chief Economist at CoreLogic, explains:

“Home prices rose 18% during 2021 in the CoreLogic Home Price Index, the largest annual gain recorded in its 45-year history, generating a big increase in home equity wealth.”

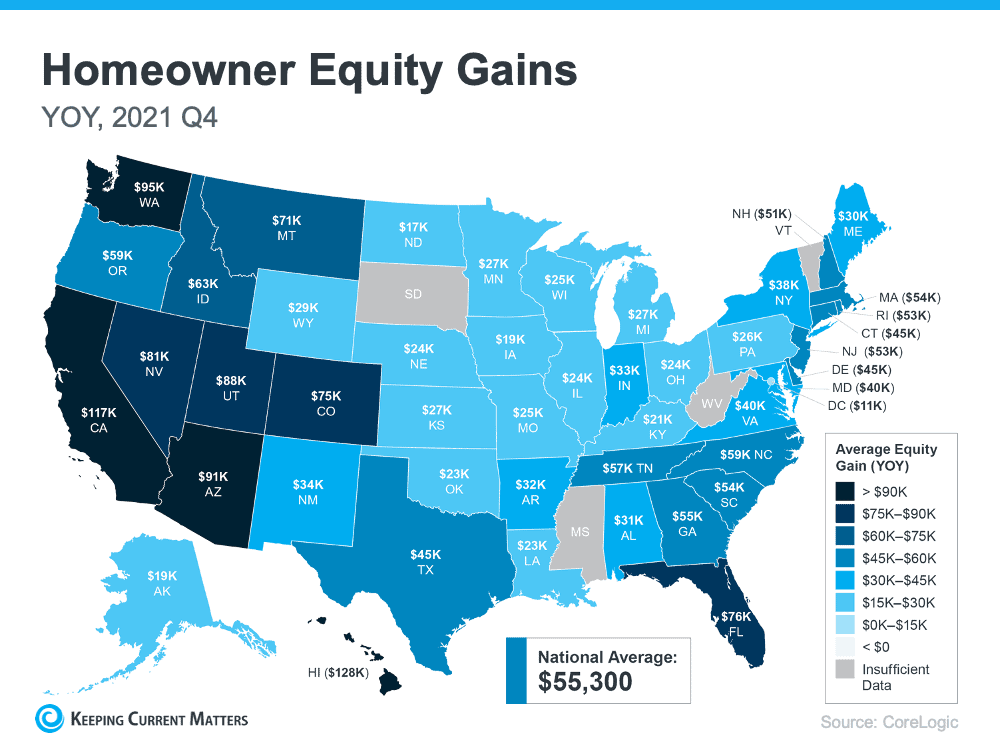

The latest Homeowner Equity Insights from CoreLogic shed light on just how much rising home values have boosted homeowner equity. According to that report, the average homeowner’s equity has grown by $55,300 over the last 12 months.

Here’s what’s happening in our state, in Washington we’ve seen the highest gains in the country, second to California. This is a breakdown of the average year-over-year equity growth for each state based on that data.

How Rising Equity Impacts You:

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home. It works like this: when you sell your house, the equity you built up comes back to you in the sale.

In a market where you’re gaining so much equity, it may be just what you need to cover a large portion – if not all – of the down payment on your next home. So, if you’ve been holding off on selling and worried about being priced out of your next home because of today’s home price appreciation, rest assured your equity can help fuel your move.

Bottom Line:

Equity can be a real game-changer if you’re planning to make a move. To find out just how much equity you have in your home and how you can use it to fuel your next purchase, please be in touch… we’d love to help!